Italian National Agency for New Technologies, Energy and Sustainable Economic Development

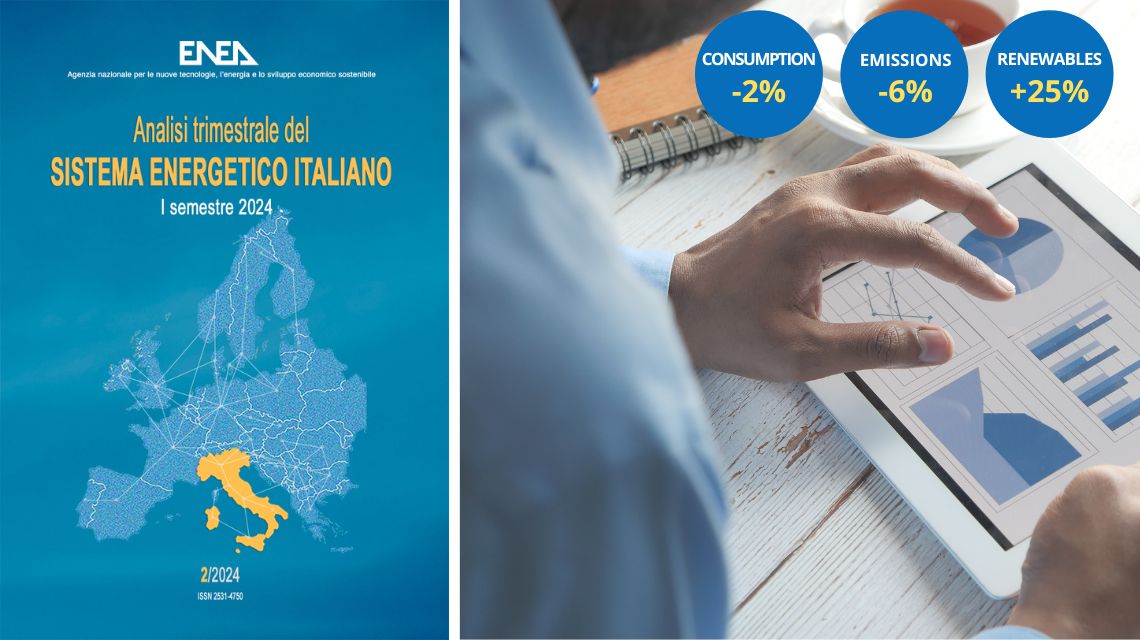

Energy: ENEA Analysis, in first half 2024 record growth for renewables (+25%), CO2 emissions down by 6%

Energy transition index still at historical low, further worsening of the Italian competitiveness in decarbonisation technologies

The ENEA analysis of the national energy system for the first half of 2024 shows an unprecedented growth of renewable sources (+25%), a sharp decrease in CO2 emissions (-6% versus -4% in the Eurozone), a record low of electricity generation from fossil fuels (38%) (10 percentage points less than the previous figure) and a new drop in consumption[1] (-2%, compared to -1% in the Euro area), to a greater extent than the trend of the main drivers (GDP and mobility slightly increasing, industrial production still negative and mild weather).

“The sharp decline in emissions refers almost exclusively to the electricity sector (-32%), due to the significant increase in the share of renewables, which rose to 44% in the semester with monthly peaks above 52%, thanks to a significant increase in hydroelectric production (+65%)”, explained Francesco Gracceva, the ENEA researcher who coordinated the Analysis.

As regards fossil fuels consumption, contractions were recorded both in coal (-60% vs -24% in the Eurozone) and natural gas (-5% vs -4%).

The analysis shows a set of difficulties for the Italian energy transition, between still insufficient decarbonization and competitiveness issues of the national industry. Although the ENEA ISPRED index[2] recorded a slight improvement, it remained near historic lows: in particular, decarbonization and prices and competitiveness values are very low. The third component, energy security, is improving, thanks to the reduced energy demand that concerned especially the electricity and gas sectors.

“The decarbonisation index benefits from emissions drop in the electricity sector, which has brought the trajectory of emissions from the ETS sectors (electricity generation and energy-intensive) largely in line with the 2030 target”, said Gracceva. However, the index has been penalised by the trend in non-ETS emissions (tertiary, residential, transport and non-energy-intensive industry), moving further away from the European targets, with CO2 emissions slightly increasing (+1%) for these sectors, due in particular to road mobility and air transport consumptions, which has returned to above pre-Covid levels. “To be in line with the European targets, emissions should decrease by an average of 5% per year; furthermore, in these sectors, the growth of renewable sources remains much lower than that outlined in the recent PNIEC”, pointed out Gracceva.

Electricity and gas prices for families and businesses, although decreasing, remained above the long-term averages, with a still wide gap between the Italian electricity exchange and the main European markets prices (in the second quarter the average Italian price rose to more that of Germany, France and Spain).

A specific focus of the Analysis highlights a decline of Italian competitiveness of energy decarbonization technologies. In fact, import dependency on low-carbon technologies has been constantly increasing since 2017, accounting for 0.34% of the GDP in 2023 with significant imbalances for photovoltaic (a -2 billion euro deficit), accumulators (-3 billions, triple that of two years ago) and low-emission vehicles (-2 billions). A slight rebound only for solar thermal and electrolysers, which however affect marginally the overall balance.